The USA has just a few issues, however the one on everybody’s minds proper now could be inflation. Rising costs imply our earnings buys much less and our financial savings are dropping worth.

Households that used to have disposable earnings to save lots of or purchase luxuries are actually struggling to pay for necessities like housing, lease or fuel.

In June US inflation reached 9.1%, the best fee since 1983. It’s fallen again barely since then, due to a dip in fuel costs, nevertheless it’s virtually sure to climb once more – and it might go loads larger.

Why Is Inflation Surging?

Economists are arguing about precisely why inflation is so excessive proper now, however most agree that a number of components have mixed to push costs by the roof.

Provide Chain Points

A worldwide provide chain disaster began creating final yr, within the aftermath of the COVID-19 pandemic that affected the entire world.

A worldwide provide chain disaster began creating final yr, within the aftermath of the COVID-19 pandemic that affected the entire world.

On the top of the pandemic, many factories had been producing a lot lower than regular or had even shut down utterly.

This created shortages of many items, though the scarcity didn’t turn out to be apparent at first as a result of, with tens of tens of millions of individuals quickly out of labor, demand for a lot of objects fell. Now demand is again, however till all of the factories are working usually once more there aren’t sufficient items for everybody who desires to purchase them.

⇒ Study How To Get 295 Kilos Of Additional Meals For Simply $5 A Week

Probably the most primary guidelines of economics is the regulation of provide and demand. This says that if extra individuals need to purchase an merchandise (demand) than there are objects out there (provide), the value will rise till provide and demand are equal.

The precept is easy: Nonetheless many individuals are keen to pay $10 for a product, barely fewer are keen to pay $11 for it. On the similar time, barely extra are keen to pay $9. In a free market financial system, costs alter to match provide and demand. The issue is that shortages push costs up, inflicting inflation.

For the reason that finish of the pandemic unemployment within the USA has fallen to a historic low, simply 3.6%. This implies extra individuals are working than ever earlier than, and that pushes demand up.

Low Curiosity Charges

It may not really feel prefer it when you have a mortgage, however for the reason that 2008 monetary disaster it’s been very low-cost to borrow cash. Low rates of interest make sense if you’re making an attempt to stimulate an financial restoration after a disaster. The issue is that when the disaster is over, low rates of interest overheat the financial system – and that causes inflation.

Associated: 10 Issues to Do on the Day The Financial system Collapses

When curiosity is low individuals, and governments, are likely to borrow cash to spend on issues they don’t really want. When individuals do this the result’s elevated demand, after which inflation. When governments do it extra money will get pumped into the financial system, demand goes up and, once more, we get inflation.

The Federal Reserve has lastly acknowledged that rates of interest have been too low for too lengthy, and has began pushing them up once more – however that’s going to be painful for anybody with debt, which is most of us.

Larger mortgage and bank card repayments will go away us much less cash to purchase issues, which ought to scale back demand and convey inflation down, however falling disposable earnings will even improve requires wage rises, and that may push inflation proper again up once more.

Vitality Costs

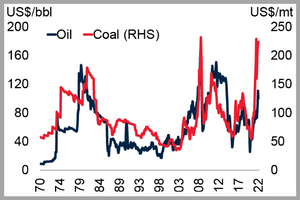

Probably the most dramatic worth rises have been for power; oil and pure fuel are main the cost, however coal costs are rising too.

Probably the most dramatic worth rises have been for power; oil and pure fuel are main the cost, however coal costs are rising too.

Vitality worth rises are very unhealthy information for inflation, as a result of dearer power places up the value of virtually every little thing else.

Costlier coal, oil and fuel means dearer electrical energy, as a result of a variety of electrical energy is generated by burning gas. Something that wants coal, oil or fuel to fabricate – and that’s a variety of issues – turns into dearer.

Something you purchase in a retailer additionally turns into dearer, as a result of the price of delivery it from the manufacturing unit to the shop rises (and so does the price of heating, cooling and lighting the shop). Probably the most painful affect for many of us is the additional price of heating, lighting and air con in our houses.

⇒ How To Produce Your Personal Electrical energy At A Low Price

The unhealthy information is that, whereas inflation is already at harmful ranges, it seems prefer it might get loads larger.

What’s Coming?

Many analysts are predicting that inflation will quickly peak, then begin to fall. Nonetheless there are some actual risks forward. The large one is the EU’s power coverage.

The European bloc plans to ban imports of Russian oil by the tip of the yr. That can scale back Russia’s exports – and the quantity of oil on the worldwide market – considerably, similtaneously the EU begins in search of new suppliers to switch Russian oil.

Associated: How The Battle In Europe Will Have an effect on The US Financial system

Oil costs are set to rise sharply. Proper now a barrel of Brent crude is promoting for $107, however JP Morgan are predicting it might rocket to $380. When you suppose fuel costs are unhealthy now, wait and see what they’re like when oil is sort of 4 instances the present worth.

We’ve already checked out all the explanations excessive oil costs push up inflation. The EU ban might blow up the entire financial system. If oil goes to $380 a barrel the value of gasoline might simply double – and the rise in transport prices would drive inflation by the roof.

It’s already working at over twice economists’ predictions for this yr, which ran from 1.69% to 4.3%. It might simply double once more. If that occurs it might set off an financial apocalypse; after a sure level inflation can begin to feed on itself.

Larger costs make calls for for larger wages irresistible, and better wages improve manufacturing, transport and retail prices, pushing costs even larger. Normally the cycle solely ends when the financial system suggestions into recession, or a full-on financial crash.

Except the Biden administration can immediately discover a miracle remedy for the rising drawback issues are going to get loads worse earlier than they get higher.