Regardless of what our authorities’s actions would have you ever consider, the warfare in Ukraine is only a distracting sideshow, and of no actual significance to America.

However there’s one other warfare happening, that will change our nation endlessly. It started the day the final American army airplane flew out of Kabul two years in the past, leaving 1000’s of Individuals behind enemy strains.

Unusual as it might sound, this has nothing to do with the Taliban or the warfare on terror.

It’s way more lethal but in addition nearly fully hidden from the American public. And whereas the mass media doesn’t report on it, this new world battle poses the largest menace to the US financial system and the American lifestyle as we’ve recognized it for many years.

By my calculations, this disaster will attain its climax in late 2023, and if we aren’t on the successful facet by then, America will merely cease being a world superpower.

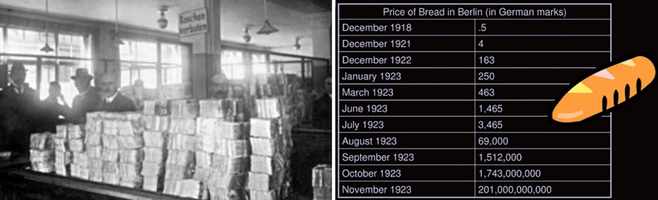

Inflation will flip to hyperinflation and really quickly years’ price of financial savings will barely cowl your subsequent few meals and payments. “Too massive to fail” firms and banks will go bankrupt, with thousands and thousands of “safe jobs” vanishing in a single day.

In the event you lose yours don’t hope you’ll discover one other one quickly. If you’re retired don’t assume your pension will enable you survive what’s coming. Properties will probably be foreclosed and flood the market inflicting an actual property crash worse than something we noticed again in 2008.

And the homeless and hungry will substitute the well-off and affluent. America will descend right into a debt spiral, however in contrast to right this moment, no person will need to lend us any cash. Our lifestyle will collapse, and the nation would possibly by no means recuperate.

I don’t make this prediction flippantly. It’s based mostly on years of in depth analysis and up to date financial details, which I’ll lay out within the following paragraphs.

You possibly can determine for your self if I’m flawed, or if that is certainly the worst disaster we’ll seemingly face in our lifetime. And should you do attain my similar conclusions, I’ll inform you how you can reap the benefits of the small window of time we’re nonetheless afforded to arrange.

Whereas this disaster entered its crucial and last part two years in the past, its seeds had been planted a lot sooner than that, simply as World Warfare II was ending.

In 1944 a lot of Europe and Asia, in addition to elements of Africa, lay in ruins.

The price of the warfare had been very excessive each in lives misplaced and industrial manufacturing capability destroyed.

What was wanted was cash and many it.

However not the war-torn currencies of European nations suffering from hyperinflation. And there wasn’t sufficient strong gold to go round for the type of large rebuilding that needed to be undertaken.

What was wanted was a brand new type of world cash, that everybody may belief.

So, in July of 1944, over 700 delegates representing 44 nations met in Bretton Woods, New Hampshire to determine on a brand new world reserve foreign money pegged to gold, which might change into the yardstick for all different currencies and the bedrock of worldwide commerce.

As America was the most important holder of gold, and virtually the one financial superpower left on the time that foreign money may solely be the greenback.

It was agreed at Bretton Woods that 1 ounce of gold would at all times be price $35. You possibly can go to the New York Fed and change your {dollars} for gold straight.

Associated: Fast Trick to See if You Have Gold on Your Property

Any foreign money is barely as sturdy because the demand for it, and this settlement created an infinite demand for {dollars} all world wide. Each central financial institution needed them to maintain in reserve to strengthen their very own foreign money, reduce change dangers, conduct overseas commerce, and repay debt.

The greenback was now simply nearly as good as gold solely much more sensible to make use of.

The greenback was now simply nearly as good as gold solely much more sensible to make use of.

Following Bretton Woods, lots of nations additionally despatched their nationwide gold reserves to Fort Knox, to be saved in custody and assist implement the brand new normal, receiving {dollars} to maintain of their vaults again house as an alternative.

By 1947, america had accrued over 70% of the world’s current gold reserves.

With the greenback in extraordinarily excessive demand, the American financial system, which was already sturdy after the warfare, began to actually take off in the course of the Fifties. And america turned the lender of selection for a lot of nations that needed to purchase dollar-denominated U.S. bonds.

The world ran on {dollars}.

America loved what the French president De Gaulle referred to as “an exorbitant privilege”. We had been the one nation on the planet that might print debt with out a ceiling. And we may pay all that debt with the cash we made out of skinny air, and no person would be capable of refuse it.

Associated: 6 Warning Indicators Earlier than An Financial Collapse That Most Individuals Miss

However with nice energy comes even larger duty – and our leaders proved something however accountable.

They printed an excessive amount of and ran the debt tab too excessive combating in Korea and Vietnam, giving billions in overseas support, and splurging on initiatives again house.

The remainder of the world began to marvel if the US greenback was nonetheless coated one to 1 in gold reserves.

By 1971 the French had misplaced religion that this was the case and despatched the French navy throughout the ocean to change {dollars} again into gold. The FED complied however the injury was performed.

The good gold financial institution run had begun.

Realizing he wouldn’t be capable of redeem all of the {dollars} for gold, President Nixon shocked the world as he deserted the gold normal that very same yr.

The greenback was now backed by skinny air, religion, and belief within the US Authorities. Unsurprisingly, its worth rapidly began to plummet.

As a direct consequence, there was excessive inflation within the early Seventies, placing the US financial system in critical hazard.

We had to determine a approach to stabilize the greenback and solidify it because the world’s reserve foreign money. This was not simple, as a result of a foreign money backed by nothing is just not very enticing.

And issues would have turned ugly for the US, had Henry Kissinger not been dispatched to the Center East to barter a deal that may pressure the greenback on everybody else.

In 1974—The US and Saudi Arabia signed a large‐ranging army and financial settlement that each nations declared “heralded an period of more and more shut cooperation.”

Successfully the US promised to maintain the Saudi Kingdom secure from its neighbors, so long as the Saudis agreed to cost and commerce their oil in US {dollars}. This led many different essential oil-producing OPEC nations to standardize their oil costs in US {dollars} – and so, the petrodollar system was born.

Associated: The First Factor You Want To Do When The Fuel Value Rises Above $5 Per Gallon

From that second on any nation that needed to buy oil would want to carry and use {dollars}.

Quickly after the Saudi deal, the whole world was buying and selling oil in {dollars}, even the Soviet Union!

The greenback may not have been backed by gold anymore, nevertheless it was now pegged to one thing simply as valuable – vitality. This created an enormous demand for US {dollars} world wide and the buck was rescued because the world reserve foreign money.

Once more, any foreign money is barely as sturdy because the demand for it.

Since then, there have been just a few threats to the Petro-dollar system most notably by Iraq and Libya that the US has handled accordingly.

America is the intermediary for essentially the most profitable commerce on the planet and far of our prosperity will depend on protecting it that manner. With a excessive demand for {dollars}, we are able to hold our inflation underneath management, as a result of all different nations subsidize our rising cash provide after they purchase oil. Successfully we’re exporting our inflation to them. It has really labored like a allure thus far.

The US issued debt like loopy, and regardless of that, we have now had tremendous low-cost debt, as a result of everybody on the market desires these valuable {dollars}.

Associated: Why Is The Greenback Shedding Its Energy? And Ought to We Be Involved?

This has gone on for 50 years now. 50 years of fiscal deficits, steady army interventions, artificially low-cost debt, and manufactured greenback demand.

However the music should cease sooner or later.

And now, a a lot larger menace to US hegemony is in play, and this one received’t be simply contained, if in any respect.

In the event you’ve been watching the information, it’s in all probability no secret that China and Russia have just lately pledged a friendship “with out limits”. Weeks after that Russia invaded Ukraine, however their friendship is just not about that warfare. They’re aiming a lot…a lot greater.

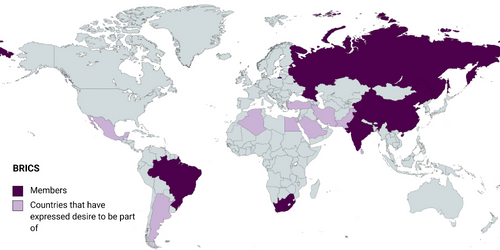

As you might also know, each nations are a part of one thing referred to as the BRICS, which is an more and more cohesive geopolitical bloc that additionally accommodates India, Brazil, and South Africa. Their governments meet yearly at formal summits and coordinate multilateral insurance policies.

The BRICS already accounts for 25% of the world’s GDP, so that they matter. And that GDP determine is predicted to extend to 50% by 2030, even when they don’t tackle new members.

Increasing BRICS will instantly speed up the method, and increasing they’re.

Within the wake of the most recent BRICS summit held in June 2022, Algeria, Argentina, and Iran have utilized to hitch the group, and within the following month, we discovered that Egypt, Saudi Arabia, and Turkey additionally expressed curiosity in changing into members.

Now when a rustic says it expresses curiosity in one thing like this, it’s often a performed deal.

All these nations can show essential new members of the BRICS, however one will show key – Saudi Arabia.

The Saudi Kingdom has been important in creating and sustaining the petro-dollar system ever for the reason that Seventies.

They had been and formally nonetheless are our allies within the center east.

However this ally is about to be a turncoat, and it’ll spell catastrophe for the greenback.

Make no mistake: the greenback is the largest financial bubble there’s ever been. When it implodes, it is going to be horrible past phrases for the US. The greenback provide would far and away exceed demand. And all that inflation we’ve been exporting for many years will come again with a vengeance.

Every part – in every single place is related to the greenback.

The way in which it begins is with the US dropping management of the oil markets.

Simply as America was retreating from Afghanistan, the Saudis signed a brand new army settlement that didn’t contain the US. This deal was made with Russia on the 24th of august 2021.

Simply as America was retreating from Afghanistan, the Saudis signed a brand new army settlement that didn’t contain the US. This deal was made with Russia on the 24th of august 2021.

Saudi Arabia has grown bored with what they understand as US disengagement from the Center East.

They’ve repeatedly accused us of failing to carry up our finish of the safety discount.

In 2019 insurgent assaults briefly lower their crude output in half. And America did nothing about it. Nevertheless it was the way in which by which we left Afghanistan that in all probability pushed them over the sting.

They didn’t belief us after that and went on to search out another person to guard them.

China has additionally been closely courting the Saudi Kingdom, investing greater than in some other Arab nation, and giving them every part they need from weapons to know-how. When President Xi visited the nation final yr, he was acquired with the best fanfare, in contrast to President Biden whose pleas for greater oil manufacturing fell on deaf ears.

As the largest importer of Saudi oil, China has already gotten them to promote a part of their oil in yuan as an alternative of {dollars}. Nigeria, one other OPEC nation is doing the identical with extra to comply with.

And that is just the start. If issues weren’t unhealthy sufficient, one thing else occurred which I’m certain you may have heard about however could underestimate the complete consequence of – the warfare in Ukraine.

Now, this could not matter for the greenback’s reserve standing. Solely it does, due to one thing the US determined to do.

When America and its allies froze over $300 billion {dollars} of the Russian central financial institution’s overseas reserve, it was seen as an unprecedented transfer.

It is usually a really harmful transfer.

Russia is just not Iran or North Korea.

It’s a main world energy. And should you change the principles for Russia, no nation is secure.

The remainder of the world rapidly took discover.

Different BRICS members and their central banks began to marvel if maybe they’re not subsequent on the U.S. financial hit listing, and it is going to be their greenback reserves that get confiscated or frozen.

Religion that the greenback was a secure asset started to erode at an accelerated tempo.

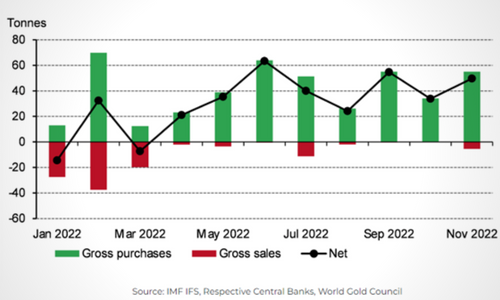

And as an alternative of it, central banks are actually diversifying their reserves into gold and different currencies, and a few are slicing their current greenback stockpiles drastically. Simply check out how their purchases of gold have accelerated just lately. And a lot of the gold is being purchased by BRICS members like Russia and China, or candidate nations reminiscent of Turkey.

Simply check out how their purchases of gold have accelerated just lately. And a lot of the gold is being purchased by BRICS members like Russia and China, or candidate nations reminiscent of Turkey.

In 2022, gold has been leaving steel exchanges on the quickest fee in recorded historical past. This was a completely large accumulation of gold by central banks.

And it’s not random in any respect.

That brings us to right this moment and the largest piece of reports that was not reported by the mainstream media.

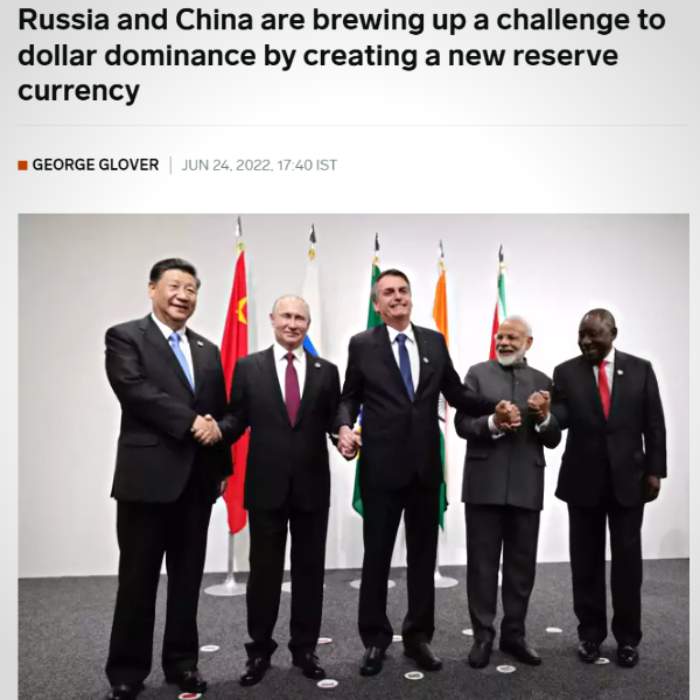

Russia and China have simply introduced the creation of a brand new BRICS foreign money that will probably be backed by all that gold they’ve been shopping for in a frenzy in addition to different commodities like oil, gasoline, and different valuable metals.

Associated: Investing For Preppers – 12 Issues That Received’t Lose Worth In A Disaster

These nations and their ever-increasing variety of allies are returning to arduous cash based mostly on tangible property. Overseas minister Lavrov of Russia confirmed simply the opposite day that this new BRICS foreign money will probably be mentioned (and doubtless adopted shortly after) on the BRICS summit that may happen in august 2023. (Supply)

Proper now, the US nonetheless has the petro-dollar to depend on, however when Saudi Arabia turns, that may rapidly collapse. As soon as it occurs, you’ll have a foreign money backed by nothing and held by the nation with the most important overseas debt on the planet, versus a brand new foreign money backed by gold and a basket of commodities.

So, let’s put all of this collectively and see how issues would possibly play out.

Someday later this yr, you’ll flip in your TV and also you’ll see the crown prince of the Saudi Kingdom, Mohammed bin Salman, flanked by Putin, Xi Jinping, and the opposite BRICS presidents, welcoming Saudi Arabia into the fold.

Associated: Might An EMP Be Putin’s Revenge Towards America?

He’ll make a pleasant speech saying thanks to the US, it’s been an awesome journey and we respect it however as you recognize we’re now being protected by China and Russia. The truth is, we struck that deal the day you pulled out of Afghanistan as a result of we realized that perhaps you’re not the perfect ones to offer us with safety.

So, we’ve now determined to open up our vitality exports in yuan, rubles, euros, BRICS foreign money, and sure additionally {dollars}. The opposite OPEC nations, closely indebted to China and reliant, on their investments will comply with alongside shortly.

And similar to that, it’s over for America.

It begins with the greenback. Each nation that has needed to personal {dollars} for the reason that Seventies to buy oil begins to dump them. This can be a downward spiral as a result of because the greenback’s worth collapses, it forces extra individuals and extra nations to transform their {dollars} to different currencies, gold, or commodities to protect worth.

Most US {Dollars} are NOT within the US As soon as all these {dollars} being dumped hit the US shores this “historic inflation” we’re coping with proper now will seem to be a stroll within the park. America will expertise true hyperinflation.

As soon as all these {dollars} being dumped hit the US shores this “historic inflation” we’re coping with proper now will seem to be a stroll within the park. America will expertise true hyperinflation.

We’re speaking a number of share factors per day, not per yr. Your cash will quickly change into nugatory, and a bag of money will probably be traded for a chunk of bread. So, what else occurs due to this hyperinflation? The FED will spike rates of interest by the roof! There is no such thing as a different manner, you might want to have high-interest charges to compensate for that type of rabid inflation.

So, what else occurs due to this hyperinflation? The FED will spike rates of interest by the roof! There is no such thing as a different manner, you might want to have high-interest charges to compensate for that type of rabid inflation.

When that occurs shares, bonds, and actual property, the opposite 3 pillars of American wealth all collapse on the similar time.

When that occurs shares, bonds, and actual property, the opposite 3 pillars of American wealth all collapse on the similar time.

The financial disaster that follows will probably be in contrast to something this nation has ever skilled in its total historical past. It should in all probability make The Nice Melancholy appear like a time of loads!

⇒ How To Get 295 Kilos Of Further Meals For Simply $5 A Week

There will probably be no secure haven asset anymore or anybody to bail us out.

Because the greenback is globally dumped your lifestyle as you recognize it would stop to exist.

And tens of thousands and thousands of Individuals will probably be thrown over the poverty line and right into a bitter struggle for survival.

Our irresponsible leaders have led us down a one-way street from which there isn’t a turning again at this level.

Because the curtain falls on the greenback, American primacy can even change into a factor of the previous. The world will transfer to a multipolar harmful new order, the place the principle reserve foreign money would be the BRICS foreign money.

Will probably be China and its allies calling the pictures any longer, not the US.

No extra printing cash to repay debt for us. No extra demand for {dollars}. No extra overvaluation of the US financial system.

Complete Collapse

For many years and a long time, we’ve lived on low-cost debt and borrowed time, manner above our means and productiveness ranges solely due to the greenback’s reserve standing.

And now it’s time to pay the piper, however we are able to’t cowl the tab.

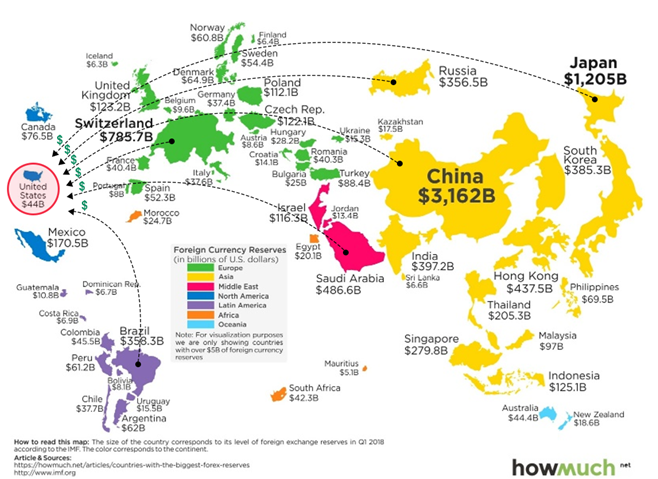

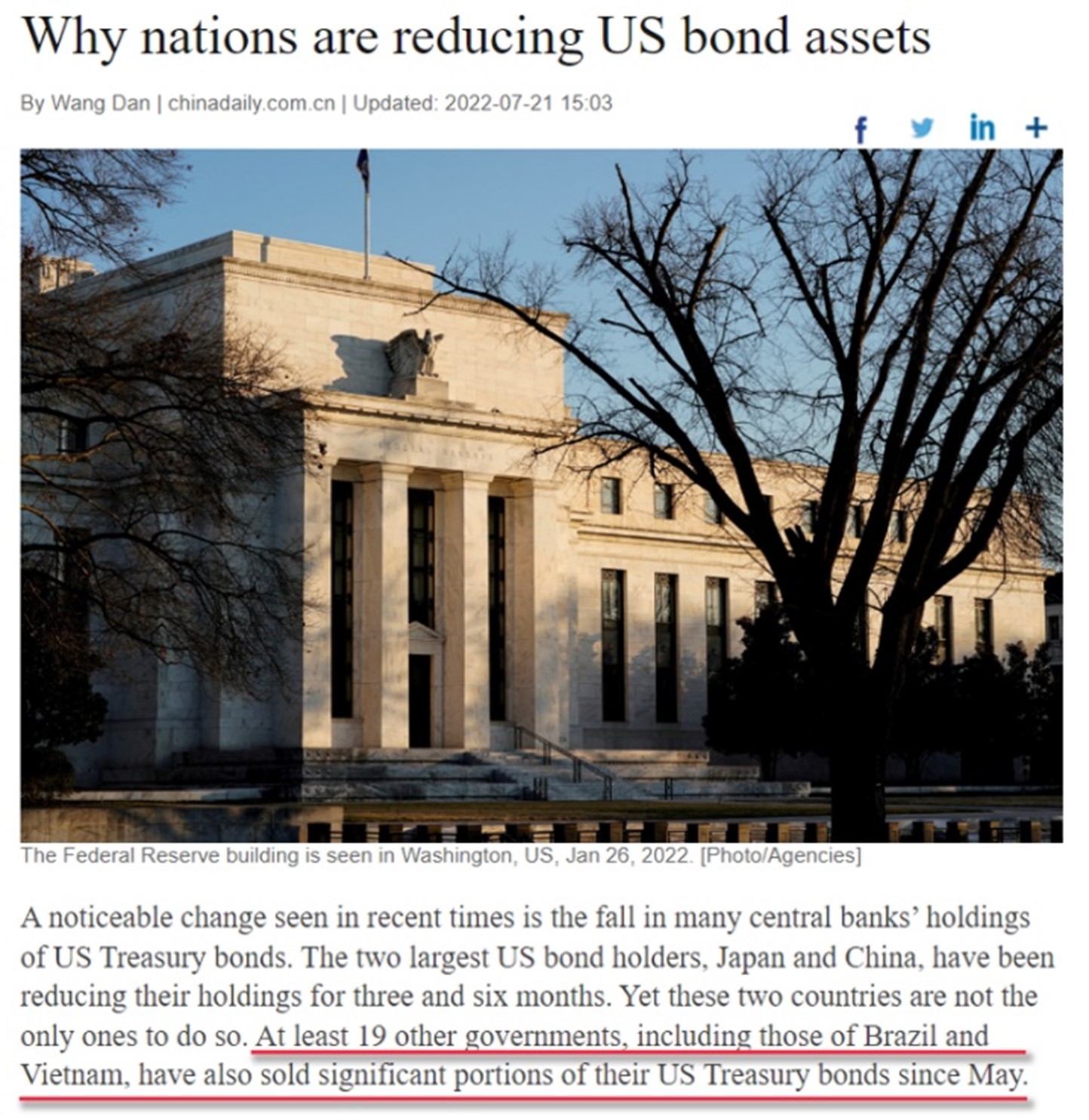

China is aware of what’s going to occur and that’s in all probability why they’ve been on an absolute hearth sale of US treasury bonds just lately, shedding their publicity from $1.3 trillion to only $870 billion in the previous couple of months.

These bonds as soon as thought-about nearly as good as gold are actually being dumped by different nations as properly.

In the meantime, the BRICS nations are pushing forward with their plan to kill the greenback.

The US would possibly by no means once more recuperate, simply as was the case with Nice Britain as soon as the pound misplaced world reserve standing. And looking out even additional again in historical past, dropping reserve standing appears to largely coincide with the autumn of empires.

The writing is on the wall, however there’s nonetheless a little bit little bit of time to arrange. The query is will you do it now or wait till it’s too late like most different Individuals?

You can not hope to cease the greenback from collapsing however what you are able to do is change into much less depending on it. Saving soon-to-be nugatory paper received’t enable you or your loved ones survive. However utilizing your {dollars} to change into self-sufficient simply would possibly. Let me present you 70+ DIY Tasks That Will Assist You Survive the Loss of life of the Greenback. These ingenious initiatives don’t price a lot or contain arduous work, however they’ll cowl each one in every of your survival wants: meals, water, electrical energy, safety, medication, communication, waste administration, and many others.

Choose those you want essentially the most and begin constructing.

We don’t have lots of time left.

You may additionally like:

Bizarre Survival Gadgets That Would possibly Save Your Life

Bizarre Survival Gadgets That Would possibly Save Your Life

The ‘Superweed’ That Saved Massive Communities Throughout The Nice Melancholy (Video)

How I Am Planning To Vanish In The Subsequent Disaster

30 Lengthy Lasting Recipes Grandma Made Throughout WWII

The Most Harmful Tree In The U.S.