It’s been a bumpy couple of years for the US financial system. In 2020 we had the pandemic and all the federal government’s panic measures to gradual it down, which noticed the primary fall in per capita GDP because the world monetary disaster in 2008.

That ultimately ended, regardless of some states making an attempt to maintain companies closed and us caught in our houses for so long as potential, however the pandemic dealt a large blow to our financial system.

It wasn’t a lot of a shock that, as life began to return to regular, inflation began to rise quick. Then, on prime of that, fuel costs shot up too, reaching an all-time file in summer time 2022.

There have positively been occasions when it seemed just like the US was wobbling on the sting of an financial abyss, and a collapse appeared like an actual chance.

Every thing’s nice now, although, isn’t it? Inflation is half what it was a 12 months in the past. Gasoline costs are excessive, however nowhere close to as excessive as they had been final June. Can all of us chill out, cease stockpiling meals and ammo, and switch the vegetable backyard right into a flowerbed?

Not so quick.

The financial system has bounced a bit, however there’s no assure it’s going to maintain on enhancing. In truth there are some pink flags that counsel we might be going through extra financial issues, even worse than those we’ve been by means of since 2020.

In keeping with the federal government’s July report, year-on-year inflation was 3.2% within the twelve months to July 2023.

In keeping with the federal government’s July report, year-on-year inflation was 3.2% within the twelve months to July 2023.

That’s increased than it’s been for many of the final 40 years, however a good distance beneath its terrifying peak of 9.2% in June 2022.

Sadly there are indicators it might be heading up once more.

In truth even the official figures present a slight upward tick from June’s 3.0%, and the truth might be lots worse.

Associated: 9 Gadgets To Inventory Up On Earlier than Hyperinflation Hits

Though grocery costs are rising extra slowly than they had been the price of vitality continues to be excessive, and that tends to power up the value of every little thing else.

The post-pandemic restoration is overheating, too; GDP grew by 5.6% within the third quarter of 2023, pumping more cash into the financial system. Over-fast progress nearly at all times fuels inflation.

Former White Home economist Kevin Hassett is pessimistic, and thinks one other wave of inflation is on its approach.

If excessive progress dangers bringing inflation again, low progress could be unhealthy for a bunch of various causes – and the Federal Reserve appears to suppose the current financial surge isn’t going to final.

If excessive progress dangers bringing inflation again, low progress could be unhealthy for a bunch of various causes – and the Federal Reserve appears to suppose the current financial surge isn’t going to final.

Whereas they admit final 12 months’s predictions of a recession had been improper, they’re much less optimistic about the long term.

Lately they’ve downgraded their predictions for progress from an annual 2.5% to 1.8%. That appears unusual, contemplating the financial growth within the third quarter, however that’s what they’re saying.

Satirically the factor probably to trigger a recession is the Fed’s personal insurance policies. Of their drive to chop inflation they’ve pushed rates of interest to their highest stage in additional than 20 years, leaving hundreds of thousands of People struggling to pay their mortgages.

Associated: Cash Saving Suggestions From Actual Survivors of the Nice Melancholy

If there’s a pointy rise in repossessions individuals aren’t going to be completely satisfied, and with the nation as indignant and divided as it’s now that might give our social stability a tough knock.

Kevin Hassett thinks the present administration is borrowing and spending loopy quantities of cash. Many different economists agree.

Kevin Hassett thinks the present administration is borrowing and spending loopy quantities of cash. Many different economists agree.

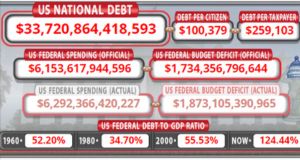

The federal authorities is quickly increase an already large pile of debt.

In some unspecified time in the future, all the cash the IRS collects in taxes can be wanted simply to cowl the curiosity on that debt; at this level, the thought of ever paying off the debt itself is a sick joke.

Republican lawmakers try to decelerate the administration’s wild spending, which is why the specter of one other authorities shutdown is looming.

So far these have at all times been ended by a compromise that lets the federal government borrow some extra cash, however GOP persistence is operating out and Home Speaker Kevin McCarthy is shedding management over his personal celebration.

There’s an actual threat that the federal authorities may not have the ability to pay its staff. That’s going to depart hundreds of thousands of very sad individuals – a lot of them armed.

The warfare in Ukraine exhibits no signal of ending anytime quickly.

The warfare in Ukraine exhibits no signal of ending anytime quickly.

And the US is slowly being dragged deeper into it.

Ukraine, understandably, needs superior western weapons to beat again the Russian invaders.

Whether or not or not serving to Ukraine is the proper factor to do – and it’s exhausting to argue the nation doesn’t have a proper to defend itself – there’s at all times a threat that if Russia begins shedding badly sufficient they’ll lash out at anybody they blame for his or her issues.

And if Russian forces are being pushed again by US-made tanks and plane it’s not too exhausting to work out who they’ll blame.

It might make no sense for Vladimir Putin to assault the US, as a result of he has no likelihood of successful, however Putin does lots of issues that make no sense. It’s very potential he may react in a rage, and set off a significant – possibly nuclear – warfare.

For now, issues appear higher – a bit, anyway – than they had been a few years in the past. This could be a nasty time to let your guard down, although. If you already know what to search for there are some warning indicators it could be very harmful to disregard.

Our financial system is finely balanced, and will crash right into a recession at any second. The federal government is playing dangerously with the nationwide debt, and risking an entire collapse of the nation.

Being ready for the worst has by no means been extra vital, as a result of it might be simply over the horizon.

You may additionally like:

How To Looter-Proof Your Dwelling

How To Looter-Proof Your Dwelling

The ‘Superweed’ That Saved Giant Communities Throughout The Nice Melancholy (Video)

Finest Backup Heaters You Can Purchase For This Winter

You Want This To Survive A FEMA Takeover

Higher Than Walmart: Shops To Get Survival Meals For a Cut price

;%20this.src=%27/assets/structure/missing_940-642588a5.jpg%27;)